Institutional

Credit Assessments

Credora generates technology-driven credit ratings and analysis,

powering efficient private credit markets

Real-Time

Analytics

Comprehensive

Reports

Transparent Methodologies

On-Chain Distribution

Real-Time

Analytics

Comprehensive

Reports

Transparent Methodologies

On-Chain Distribution

Loans Facilitated

Distribution

Partners

Credit

Ratings

Trusted By Industry Leaders

Hear It From Our Users

Credora’s processes are streamlined and transparent, allowing us receive a comprehensive credit assessment and distribute it across a network of counterparties. Operationally, this allows us to efficiently access crypto capital markets.

Jonney Liu

Co-CEO, Co-Founder

Working with Credora & Clearpool allows us to tap into crypto credit markets and run a more capital efficient book. The crypto lending space is currently fragmented and illiquid. Credora’s systematic and data-driven approach helps to demystify the risks, making it easier for us to access capital.

Shiliang Tang

Co-Founder, Arbelos Markets

Credora performs a thorough and streamlined Credit Assessment, ensuring transparency for Clearpool lenders, and equipping us to more effectively engage various credit providers throughout the ecosystem.

Martins Benkitis

CEO & Co-Founder of Gravity Team

Credora’s straightforward and transparent credit assessment process meant we were easily able to prove our creditworthiness, and successfully raise funds on Obligate.

Urs van Stiphout

Co-Founder & CEO

Through precise analysis of our financial statements and our policies and procedures, Credora has helped us reaffirm our credit analysis standards and coverage ratio for our liquidity management, strengthening our credibility with investors.

Thomas Heinig

Chief Risk Officer at Mikro Kapital Management S.A.

We appreciate Credora’s prompt and detailed credit assessments, which allow us to benchmark our debt issuances to traditional ratings. This has helped us repeatedly place our eNotes on the Obligate regulated platform in Switzerland. We look forward to continuing our successful partnership with Credora.

Dr Tom James

CEO & CIO

We found the Credora platform intuitive to use, and their team’s accessibility during the Credit Assessment process greatly aided our understanding of their standardized methodology.

Sandro Huwyler

Head Treasury of Bitcoin Suisse

Credit risk in the crypto sector remains obscure and difficult to quantify. Credora raises reporting standards, improves transparency, and sets the benchmark for risk assessment in this space.

Adam Bilko

Portfolio Manager at RockawayX

Setting a high standard for credit due diligence will help the lending industry scale. Credora’s platform allows for easier borrower analysis with structured financial data, asset validation, and neutral third party analysis.

Yichen Wu

CEO of Tesseract

We appreciate Credora’s commitment to high standards in credit due diligence, enabling us to conduct thorough and efficient evaluations.

Benjamin Zhu

CEO of Azure Tide

XBTO’s Tokenization Division leverages Credora’s advanced third-party credit assessments, ensuring the transparency and security required to confidently offer innovative tokenized assets to qualified and institutional investors.

Javier Rodgriguez-Alarcon

CCO of XBTO

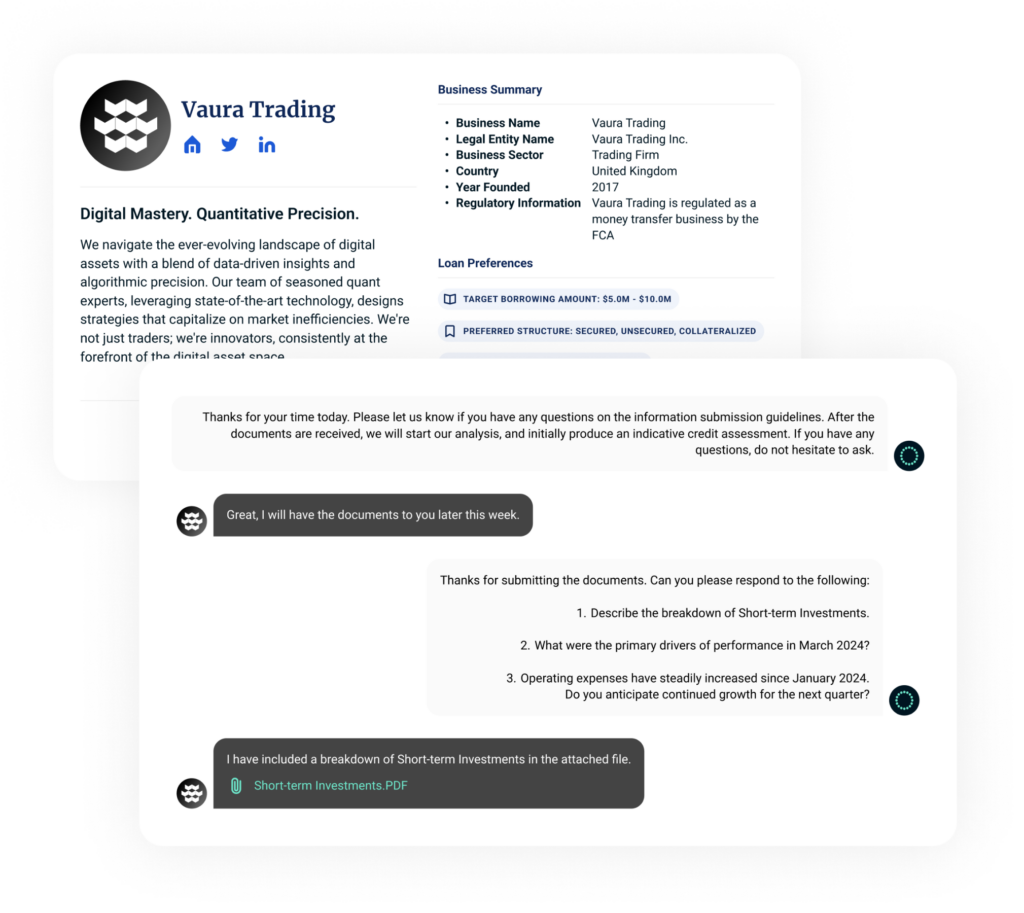

Seamless Platform

Experience

Onboard and submit credit information on a secure and intuitive platform

Directly access Credora’s Credit Team, and receive guidance through a simple chat interface

Search for potential counterparties, and expand your network

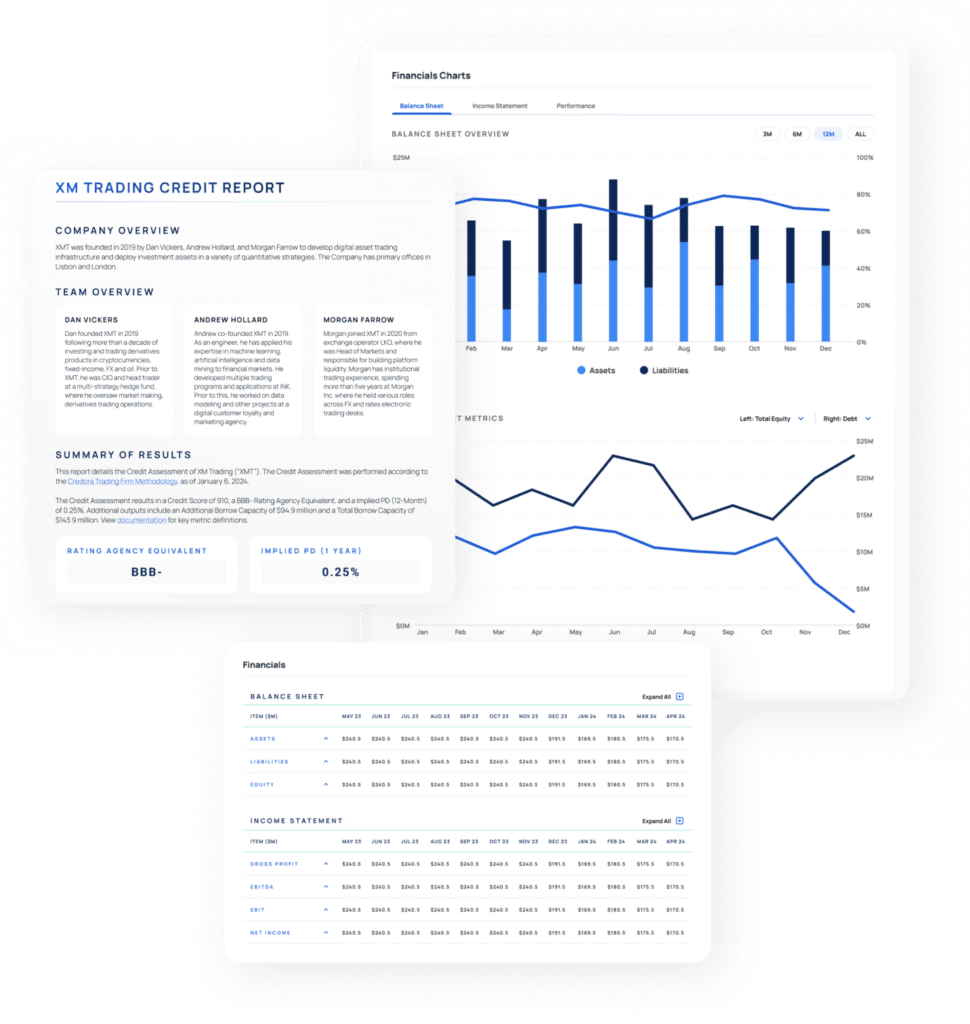

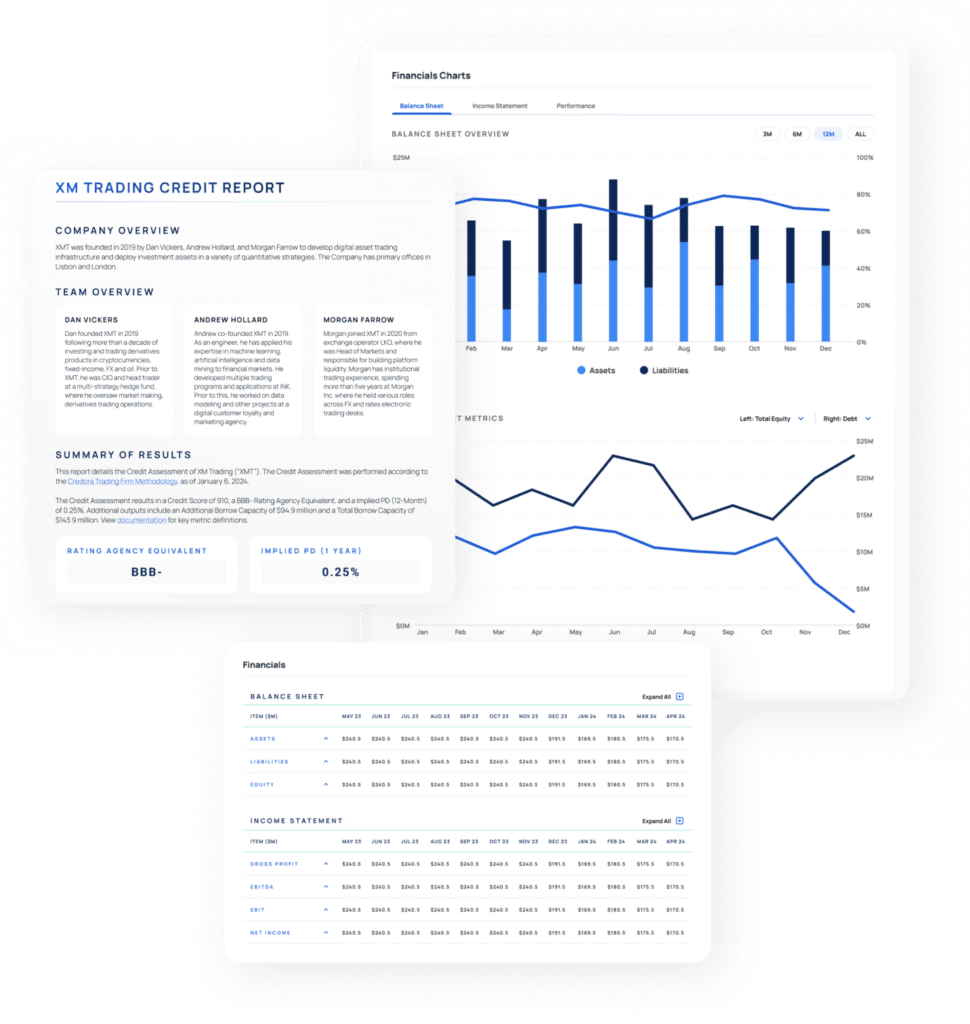

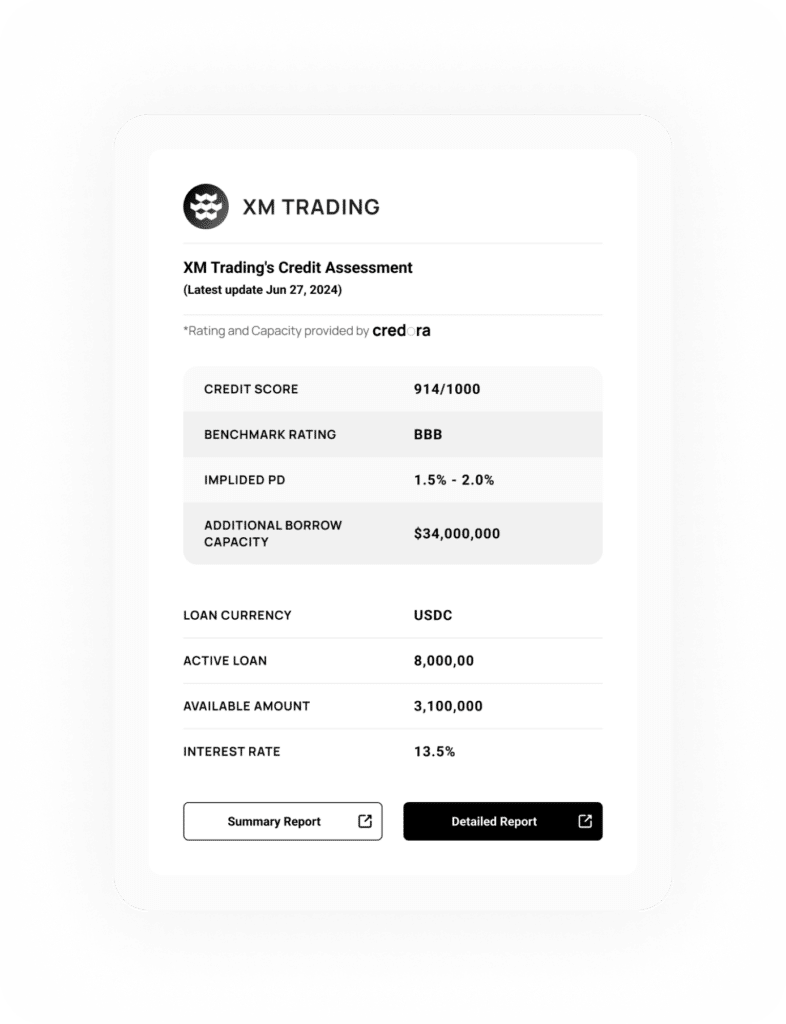

Comprehensive

Credit Reports

Control the distribution of Credit Reports and Financial Reports, on and off the Credora Platform

Access the latest borrower information, analytics, and benchmarking data

Configure report contents, control and monitor viewership

Comprehensive

Credit Reports

Control the distribution of Credit Reports and Financial Reports, on and off the Credora Platform

Access the latest borrower information, analytics, and benchmarking data

Contribute report contents and control viewership

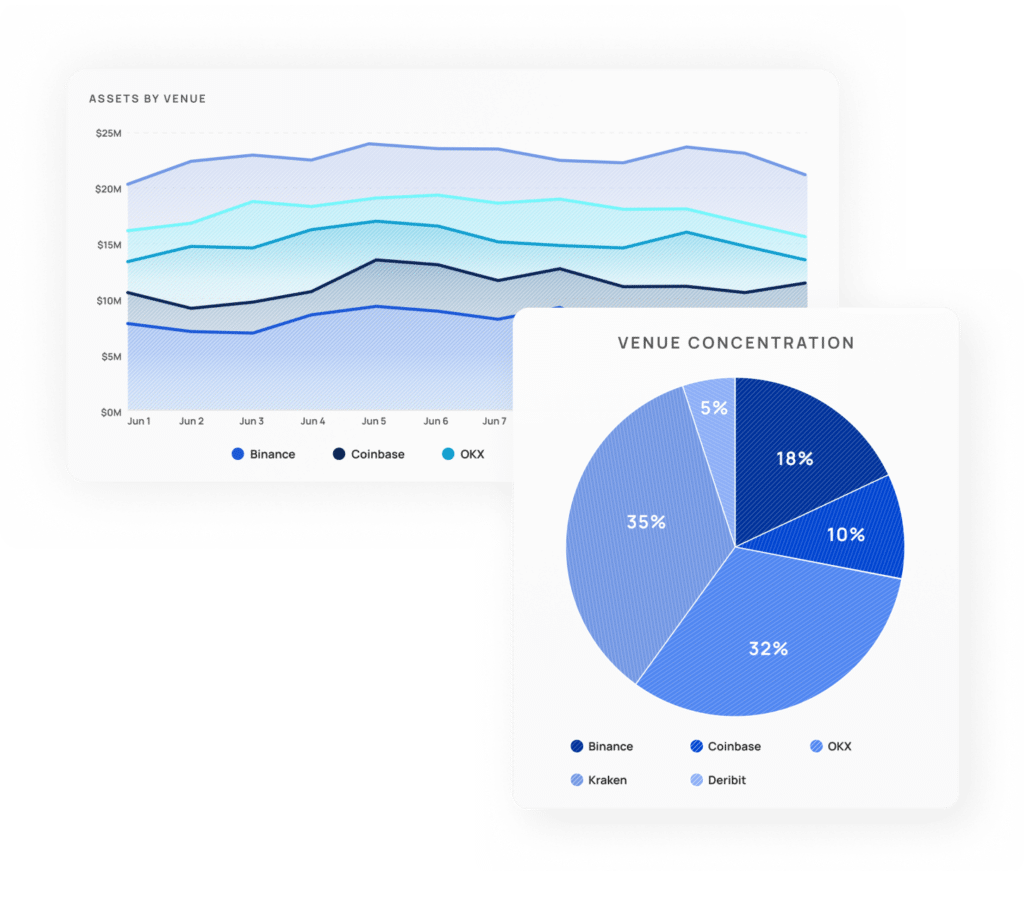

Real-Time

Analytics

Analyze data which statistically serves as a proxy for financial statement metrics

Validate reported financial information, relying on data directly from the source

On-Chain

Credit Metrics

Seamless smart contract integration for DeFi applications

Unlocking programmatic credit extension and secondary market liquidity for debt

On-Chain Credit Metrics

Seamless smart contract integration for DeFi applications

Unlocking programmatic credit extension and secondary market liquidity for debt